Revenue Recognition

Metric AI’s Revenue Recognition feature allows you to define and automate how your organization recognizes revenue. Whether you have fixed-fee projects or want to attribute revenue based on hours logged, this feature gives you flexibility to accurately capture your financial performance and profitability.

Recognition Methods

Based on Logged Time

When your organization logs hours against tasks, you can distribute revenue proportionally to the hours worked. This method helps you see how much revenue each individual, role, or team contributes based on their share of the total time logged.

Example Use Case:

A $10,000 fixed fee project has 200 total logged hours. Each hour is

effectively worth $50 ( $10,000 / 200 hours ). If a developer logged 40 hours,

they are attributed $2,000 of recognized revenue.

Based on Attributed Cost

In scenarios where you want revenue to reflect the cost of the resources involved, you can assign a cost rate to each individual or role. Metric AI then calculates the share of recognized revenue for each person based on their portion of the total cost.

Example Use Case:

If your project revenue is $10,000 and the total labor cost is $4,000, each

person’s recognized revenue share is calculated based on their percentage of the

total cost. If a designer’s cost was $1,000 out of $4,000, they would receive

25% of the recognized revenue (i.e., $2,500).

Capping Recognized Revenue

If your project or contract dictates that the recognized revenue must not exceed a certain amount, you can set an upper limit (cap) in Metric AI. This allows you to stay compliant with contractual or regulatory requirements by preventing revenue from being overstated. You can adjust this cap as needed, ensuring that your financial records remain precise and aligned with any evolving budget or agreement.

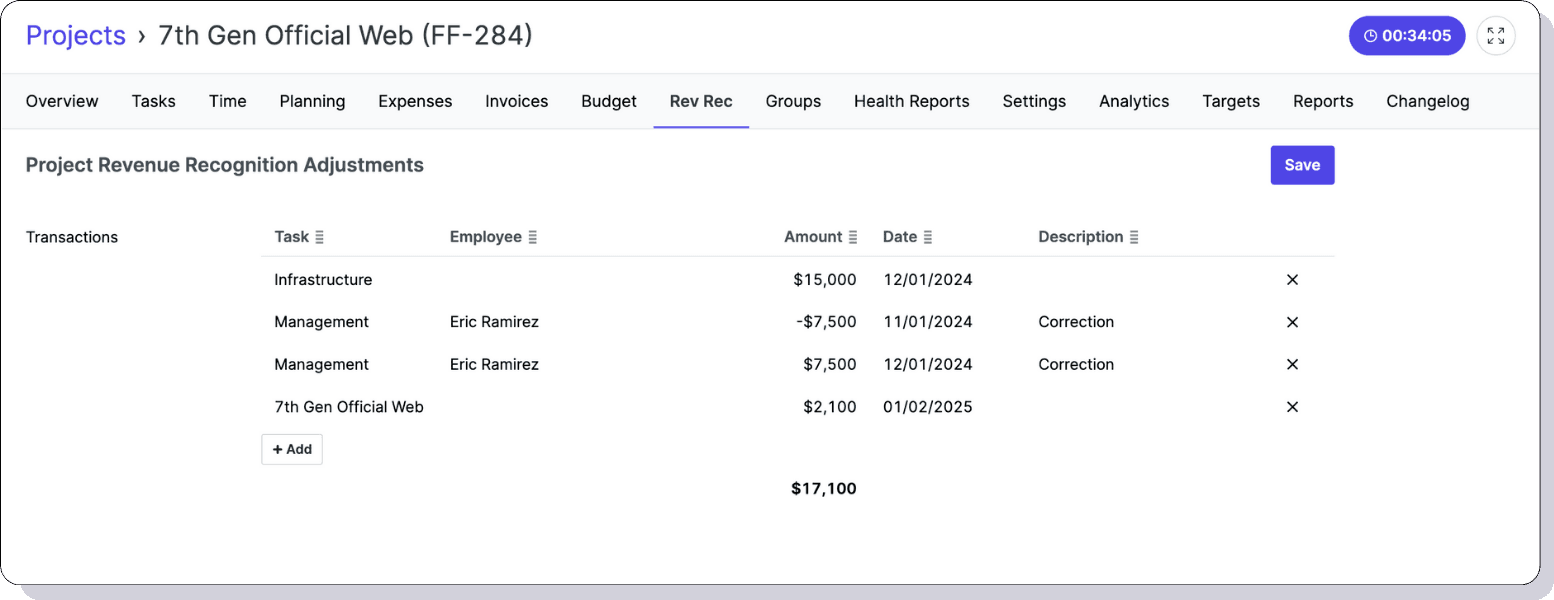

Manual Adjustment Transactions

Manual Adjustment Transactions allow you to modify recognized revenue outside the standard allocation logic. For instance, you can shift revenue from one month to another if you need to align project earnings with the correct billing period or reflect a changed delivery schedule. This feature is also useful for applying unplanned discounts, capturing mid-project scope changes, or correcting billing errors. Each adjustment is logged with an audit trail, ensuring full transparency and accountability in your financial records.